Credit checks are essential for understanding a company’s past — defaults, legal actions, payment history – but they only show what’s already happened.

It’s like when a doctor assesses your heart: they don’t just ask if you’ve had a heart attack. They run tests to catch symptoms early.

Our Financial Risk Assessments (FRA) do the same for suppliers. Helping you spot the early symptoms of financial distress before they eventuate.

Take the recent insolvency of a high-profile construction company…

Everything looked fine from the outside: no defaults, no court actions, and a strong credit score.

A Credit Report right before the collapse would have shown a near-perfect score. 24 hours later, that score would have tanked.

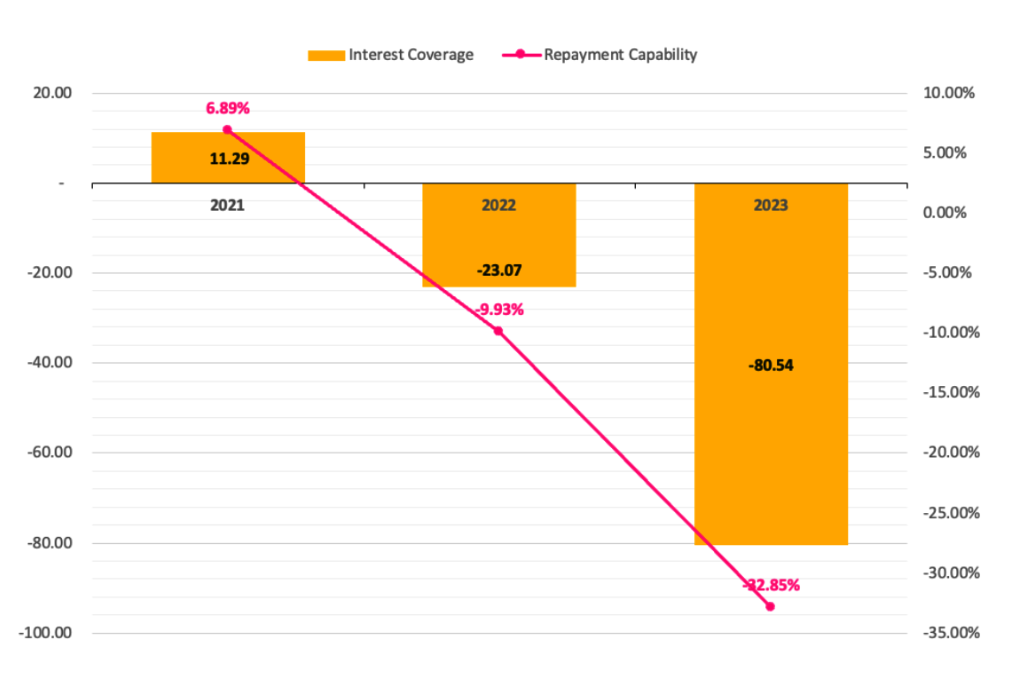

Our Financial Risk Assessment rated them as “Vulnerable” – flagging the company’s financial position had deteriorated significantly over the past year.

Our financial analysis revealed:

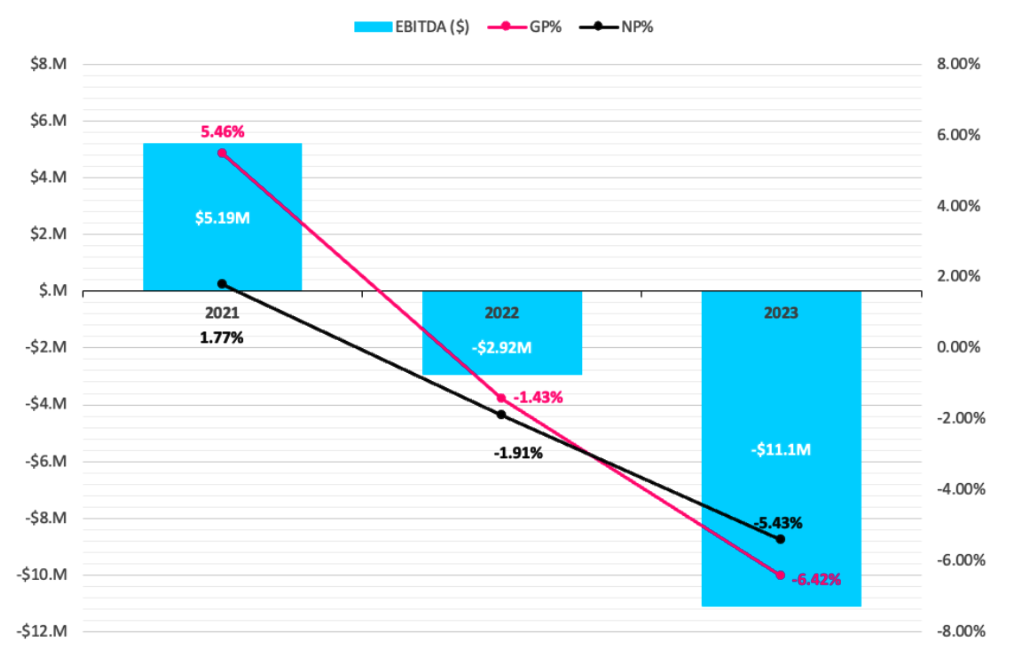

1. Profitability: Continuous cash losses were eroding their financial foundation.

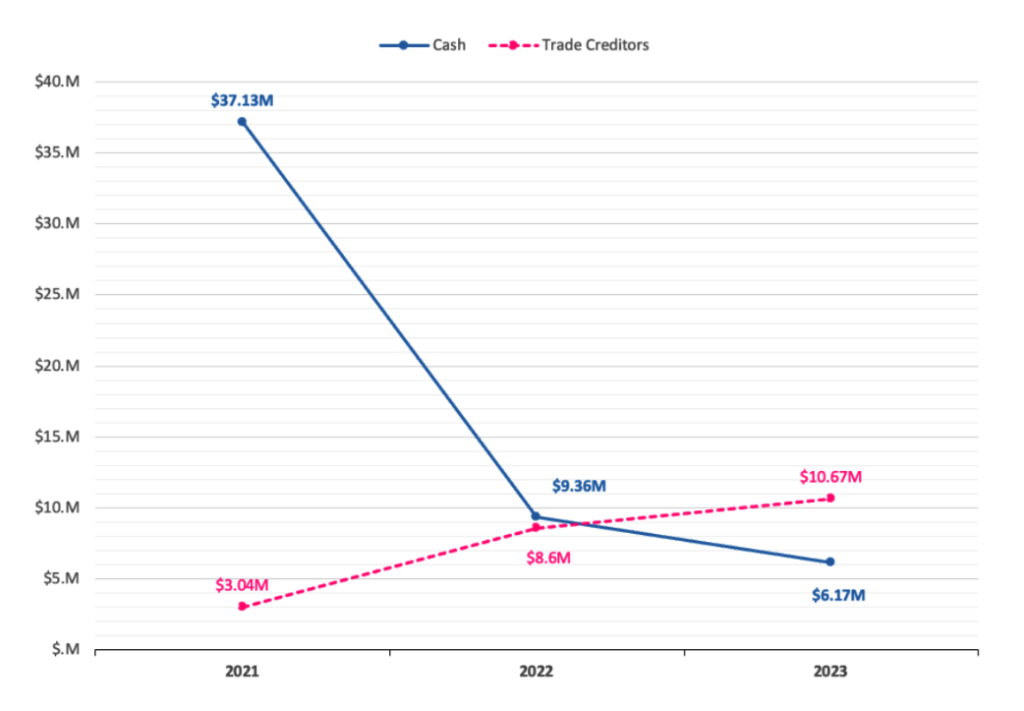

2. Working Capital: Poor liquidity meant they couldn’t pay suppliers on time — an especially dangerous situation in construction.

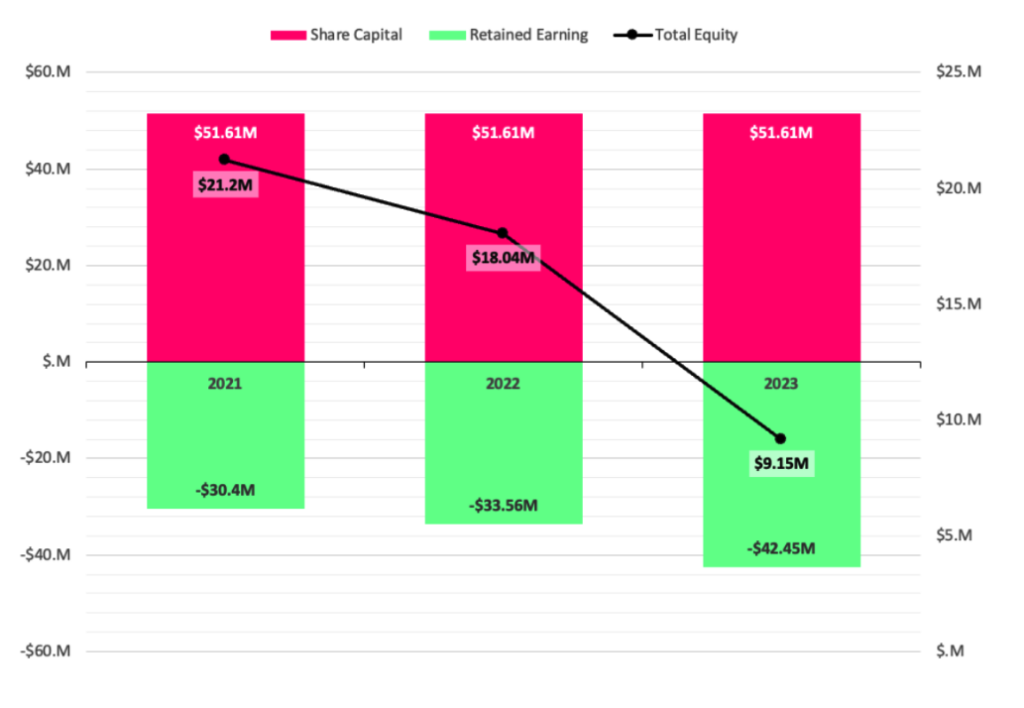

3. Equity: Losses were eating away at their equity, leaving them unable to absorb shocks.

4. Leverage: They were falling behind on payments to creditors, further limiting their ability to secure financing.

The diagnosis was unmistakable: financial distress.

Yet a Credit Report would have issued them a clean bill of health.

We advised our clients to proceed with caution. And sure enough, within months the company collapsed, leaving 21 projects in limbo.

For critical suppliers, relying on a single data point isn’t enough.

It’s useful to know if someone has had a serious health issue in the past. But there’s a first time for everything, and you must monitor for early warning signs too.

Why not use every tool at your disposal to protect against the cost, disruption, and reputational risk of supplier financial distress?

03 8768 9305Level 1/678 Victoria St,

Richmond VIC 3121

© 2025 CREDITSOURCE PTY LTD | ALL RIGHTS RESERVED | PRIVACY POLICY