A procurement leader recently shared their experience of working with a prominent construction company for over a decade.

The company was reliable, well-established, and widely recognised through billboards and big-name clients.

When rumours of financial trouble surfaced, the procurement leader brushed them off. Sure enough, the problems materialised and the company entered administration.

…leaving the procurement leader with a serious disruption to a critical project.

Unfortunately, this isn’t an isolated case.

In the past year, 2,711 construction companies have gone into administration.

That’s a 140% increase from the previous year.

High-profile insolvencies have left many projects unfinished – with customers, companies and communities forced to wear the costs and start over.

And well-established companies are not immune to financial trouble.

This challenges the long-held belief that mature, established suppliers are less risky.

Consider these high-profile insolvencies:

Not exactly the new kids on the block, are they?

The reality is that no company is invulnerable.

Yet procurement teams still get caught off guard when mature suppliers collapse.

Why? It may have something to do with these risky procurement “shortcuts”:

When mature suppliers fail, the defence is almost always the same:

“These were mature, established companies. Trusted for years.”

Loyalty is admirable. But it’s also risky.

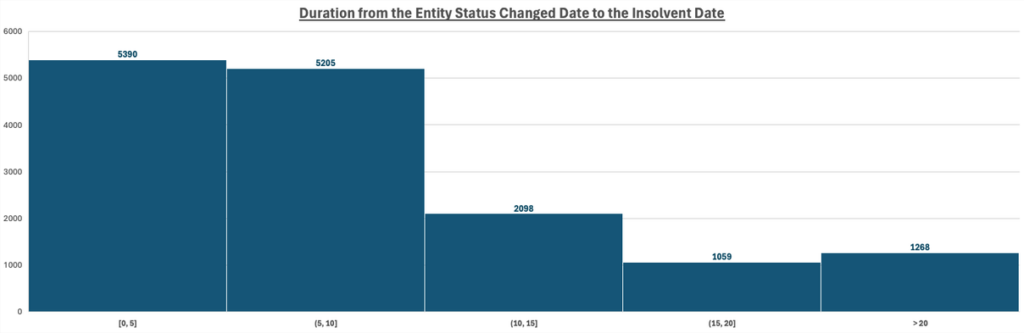

To demonstrate the point, we analysed 24,000 recent insolvencies.

Here’s what we found:

So, how do you protect your business from supplier insolvency?

The key is proactive supplier risk management.

Never assume that a long-standing supplier is financially sound.

Continuously monitor their financial health. Look for early warning signs – delayed payments, changes in project timelines, or rumours of financial strain.

Diversify your supplier base to reduce reliance on any single company. Always have contingency plans ready, so you’re prepared if the unexpected happens.

Stay vigilant, manage risks, and never assume stability.

Even the oldest trees can fall in a storm.

03 8768 9305Level 1/678 Victoria St,

Richmond VIC 3121

© 2025 CREDITSOURCE PTY LTD | ALL RIGHTS RESERVED | PRIVACY POLICY