Growth is often viewed as a key indicator of financial strength.

However, as our study of 25,000 Australian private companies demonstrates, the belief that higher revenue leads to greater profits, is not always true.

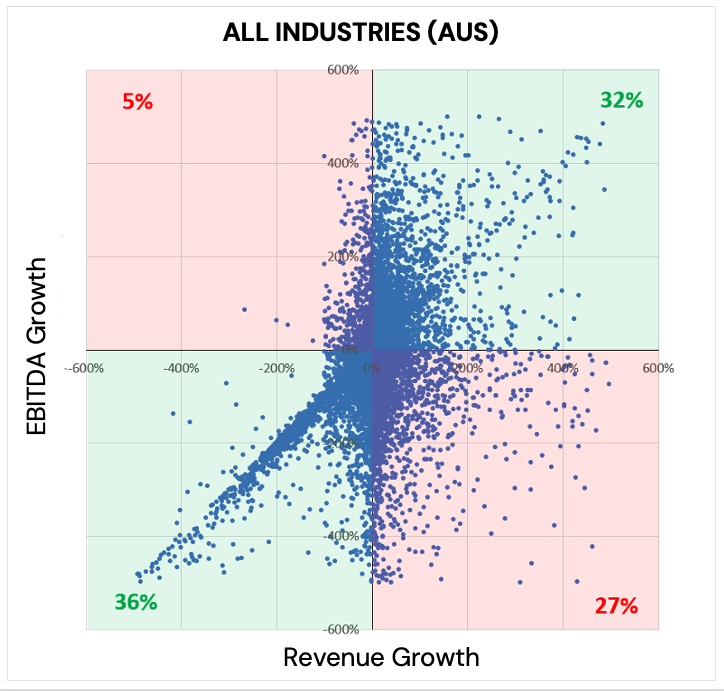

We analysed the relationship between revenue growth and EBITDA – a widely recognised profit metric – for 25,000 private companies across various industries over several financial years.

Our findings challenge the assumptions that:

In fact, those assumptions only held true for 68% of companies studied. (See: two green boxes.)

27% of businesses with growing revenues actually saw diminished profits or incurred losses. Even more intriguing, 5% experienced profit growth despite a downturn in revenue. (See: two red boxes.)

Note From The Author: While businesses sometimes chase sales growth at the expense of immediate profit for strategic positioning, generally, the goal is to bolster profitability.

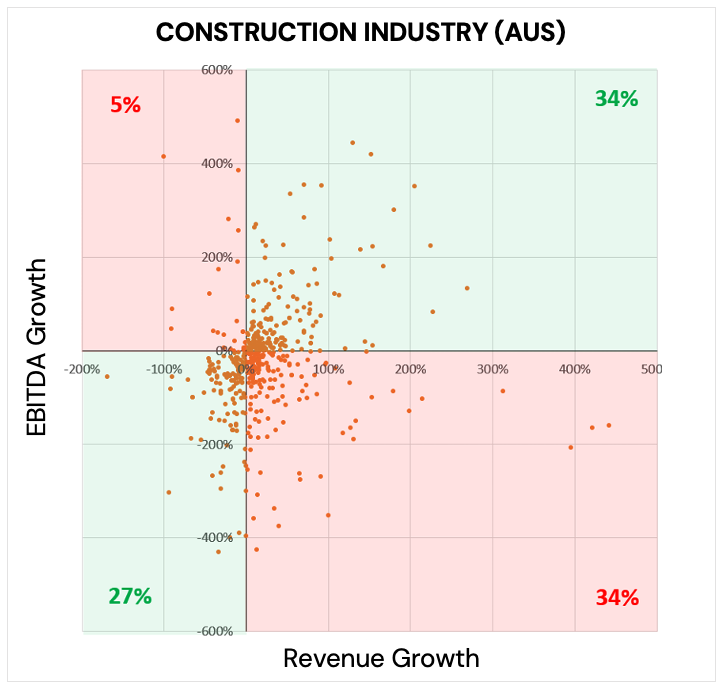

Of the key industries we investigated, the construction sector – facing challenges since 2019, with its escalating material costs, labour shortages, and supply chain woes – had the highest percentage of companies where EBITDA reduced while the revenue grew.

Here, 34% of companies with revenue growth had falling profits, compared to 26% across all industries.

This means revenue growth in the construction industry is 30% more likely to be met with declining profits compared to national averages.

The interplay between revenue growth and profitability is far more complex than conventional wisdom suggests.

Data shows that profits do not always improve when the sales are increased. So looking at revenue growth alone to gauge the success of a company could be misleading.

A better approach is to consider a wide range of metrics – including industry-specific insights – and seek to understand the broader context of the organisation’s financial position.

03 8768 9305Level 1/678 Victoria St,

Richmond VIC 3121

© 2025 CREDITSOURCE PTY LTD | ALL RIGHTS RESERVED | PRIVACY POLICY