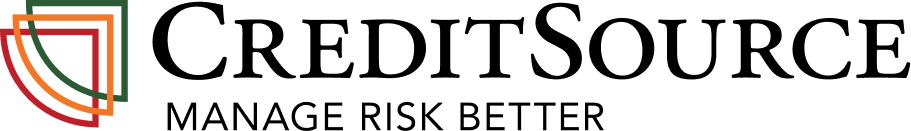

Quenos has been reporting losses for several years. While the Company was able to push the revenue up, they continued to make losses. The cumulative losses for the last three years alone was close to $500 million.

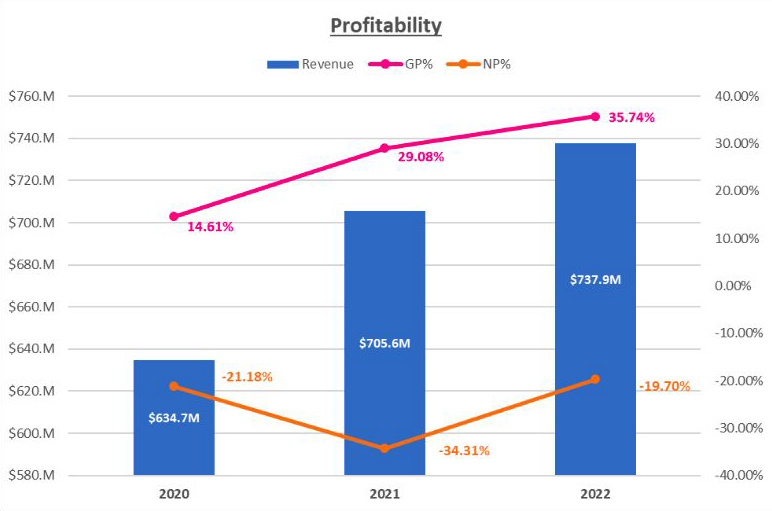

The liquidity position as of the end of FY22 showed distress, given that the financial statements reflect a net current liability position; that is, the current assets available are insufficient to settle the current liabilities due.

Delays in the settlement of suppliers and an overall shortfall in cash to pay creditors as debts fall due signalled a crisis in business.

The increase in current liabilities in FY22 is attributed mainly to the classification of $257 million of loans payable to ‘shareholder entities’ as payable within 12 months.

These loans were previously classified as payable within 2-5 years, in FY21. In FY21, no related party loans were payable within a year, while the entirety of loans payable to related parties of $333 million was due within 2-5 years.

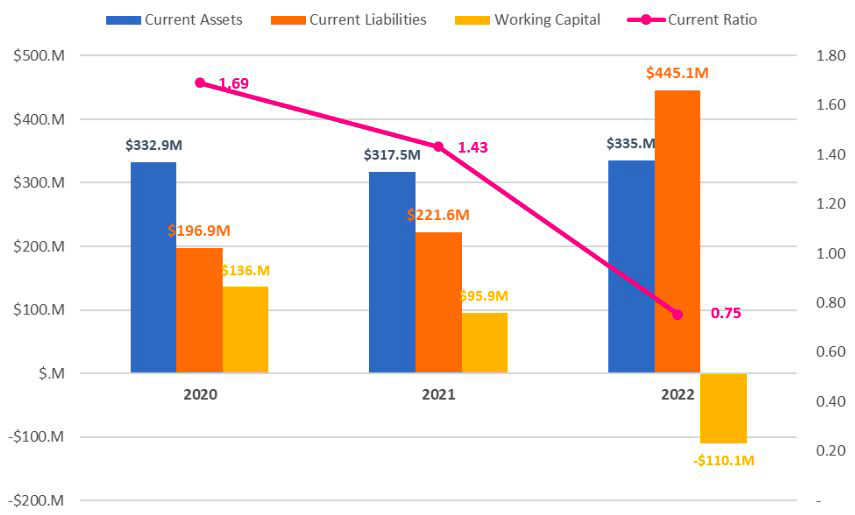

Accumulated losses progressively increased against the net losses reported over the years. While share capital remained static, equity levels continued to deplete against the rising accumulated losses.

By the end of FY21, the accumulated losses had risen to a level that wiped out the owners’ share capital, and a negative equity position of $27 million was reported. This position deteriorated further by the end of FY22 to negative $55 million, following the net losses incurred during the year.

Negative equity implies that the Company has insufficient assets (current and non-current) to settle all its liabilities.

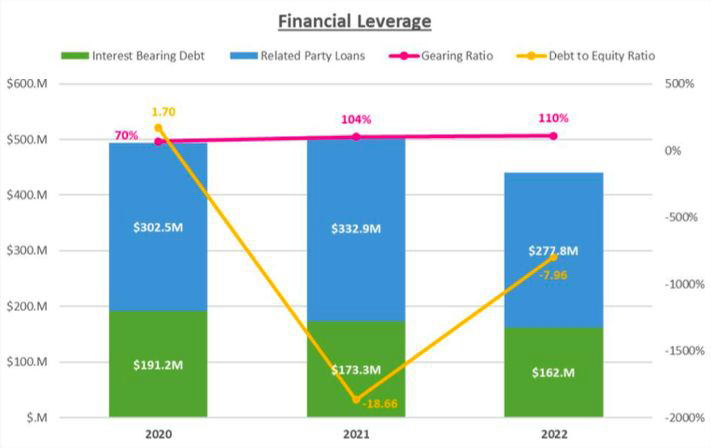

Overall, debt levels have reduced in FY23. However, the Company remains highly leveraged and is dependent on related party borrowings.

With $277 million being classified as current and payable within 1 year, there was no path for the company to settle the debt.

Substantially increasing activity levels or increased borrowings from external parties were not going to be viable options, considering:

03 8768 9305Level 1/678 Victoria St,

Richmond VIC 3121

© 2025 CREDITSOURCE PTY LTD | ALL RIGHTS RESERVED | PRIVACY POLICY